The Enduring Power of Branding in the Antibody Market

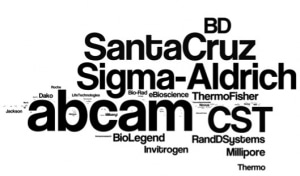

The market for antibodies currently has a very large number of suppliers. Given the importance of trust in this particular market, it is not surprising that leading suppliers invest heavily in order to develop enduring brand loyalty. In our report, The 2017 Market for Research Antibodies: Keys to Success for Commercial Suppliers, one of the first questions we asked was “When thinking about commercially available antibodies, which brands come to mind?” Hundreds of brands were named but as you can see from the word cloud below, about 20 brands enjoy the highest levels of “mindshare”.

Brand Awareness

Despite the potential for brand confusion – and the values they represent – customers default to that with which they are familiar. Fear of the unknown is a driver to continue purchasing from known suppliers. We can see from this graphic that unaided awareness is highest for Abcam, Sigma-Aldrich, and Santa Cruz Biotechnology, however scientists are also aware of many other suppliers and brands as well.

Brands represent an implicit promise between suppliers and customers and tampering with brand value or positioning in the antibody market can be dangerous – which explains why it is rarely done. Even in a time of corporate mergers and acquisitions, antibody brands are carefully preserved. For example, Thermo Fisher Scientific is a supplier of a wide variety of different antibody brands and sub-brands. Invitrogen is a Thermo Fisher Scientific antibody brand, with Molecular Probes and eBioscience both sub-brands under the Invitrogen umbrella. Similarly, both Lab Vision and Pierce are both antibody sub-brands under the Thermo Scientific parent.

Perhaps not surprisingly, we also saw a correlation between brand awareness and brand usage. Abcam, Cell Signaling Technology, and Sigma-Aldrich are the top three brands in terms of laboratory spend on antibodies. In other words, there’s a connection between “mindshare” and “share-of-wallet”.

Brand Satisfaction

Of course, a one-time sale is never the goal of a strong business. Satisfying customers so that they return and purchase again is a very high priority. We found that overall satisfaction is highest for Cell Signaling Technology, Molecular Probes, and Sigma-Aldrich.

Overall, customers were most satisfied with the form of antibodies offered by whomever they indicated as their primary supplier. However, each brand we analyzed presented a unique profile of differing levels of satisfaction across each of the product feature we measured, including:

- Antibody form (e.g., whole molecule, F(ab’)2 fragment, etc.)

- Antibody optimization for stated applications

- Available validation data from supplier

- Conjugation options

- Lot-to-lot consistency

- Multi-functionality (e.g., ELISAs, flow cytometry, Western blots, etc.)

- Pricing

- Sizing options (e.g., 0.25 mg, 10 tests, 0.1 ml, etc.)

- Species cross-reactivity

- Specificity and sensitivity

We found that while Molecular Probes is the most highly rated across all performance categories, other brands have a clearly identifiable area of excellent performance.

Brand Loyalty

Our report utilizes the calculation used in Bain & Co.’ s Net Promoter Score® (NPS) methodology. NPS is an index ranging from ‐100 to 100 that measures the willingness of customers to recommend a company’s products or services to others. The score is based on a simple calculation:

Net Promoter Score = Percent of promoters – percent of detractors

In our survey, we asked scientists to indicate their willingness to recommend their primary supplier of antibodies on a 10-point scale.

- Promoters who answered 9 or 10 are enthusiastic scientists who are loyal to their supplier (repeat purchases) and encourage colleagues to do the same.

- Passives who answered 7 or 8 are satisfied scientists, but are likely not completely loyal to their supplier and are vulnerable to switching.

- Detractors who answered 6 or lower are dissatisfied scientists who likely will switch suppliers and will influence others to defect if possible.

The average Net Promoter Score (NPS) for the nine leading brands in the antibody market is 6.8 – which is low by the life science tools industry. For example, here are the average NPS scores for three other markets that we track:

- Real-Time PCR Market – 17.5

- Cell-Based Assay Market – 15.0

- CRISPR/Cas9 Market – 12.8

To be fair, the average NPS score for antibody suppliers was dragged down by the under-performance of one leading brand confronted by a -61.5 score.

Overall, antibody suppliers can maximize their share and position by maintaining trust between themselves and their customers. Providing validation data, increasing validation efforts, or providing information on what, if any, standardization or validation programs are underway, may help foster trust between customers and potential customers. Maintaining availability, consistency, and quality of key antibodies and expanding antibody offerings are likely as important, as scientists will move on if they simply can’t get what they need. The 2017 Market for Research Antibodies: Keys to Success for Commercial Suppliers is a valuable resource for understanding the various criteria laboratories use to choose their antibodies suppliers, the critical touchpoints in the purchasing process and how to build brand loyalty based on trust.