Life Science Customer Experience: What You Need to Know

From when they first enter your website, to placing an order through a sales rep, to using technical support when setting up a new system — every time a scientist interacts with your company a branding opportunity presents itself. A dedicated customer experience program has a formal strategy to engage and satisfy, not merely serve.

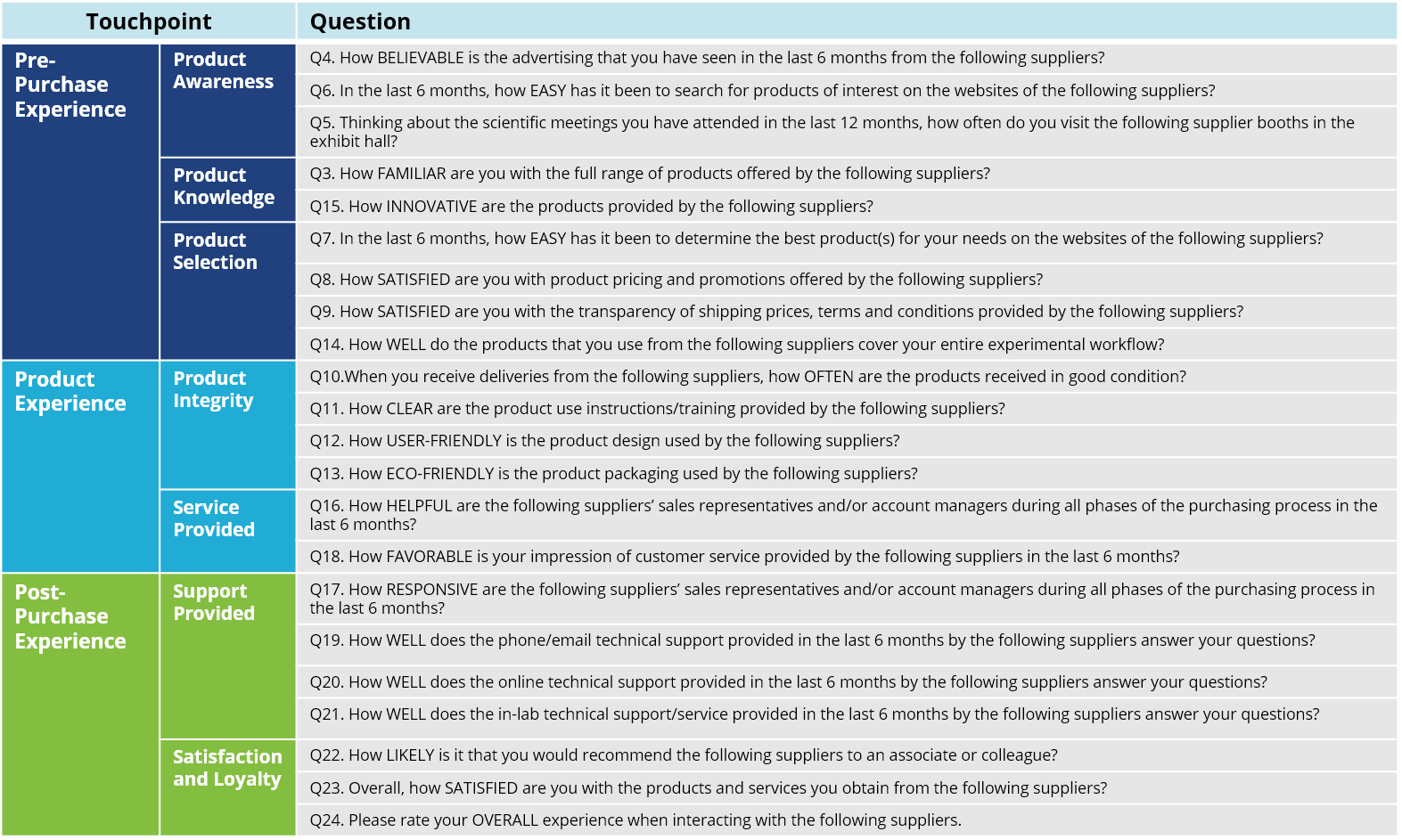

Here at BioInfo, we have been studying these patterns and changes for over three years. Our newest report Benchmarking for 2019: Life Science Customer Experience, evaluates the complete customer journey (pre-purchase, purchase, post-purchase) at each touchpoint for 27 leading life science suppliers and trends this data over 2016, 2018, and 2019. Our report can help you better understand how you are doing amongst your competitors as well as understand what a great customer experience really means to life scientists. Here, we share a few insights from the report, as well as from the interviews we conducted, to help you understand what customer experience for life scientists means.

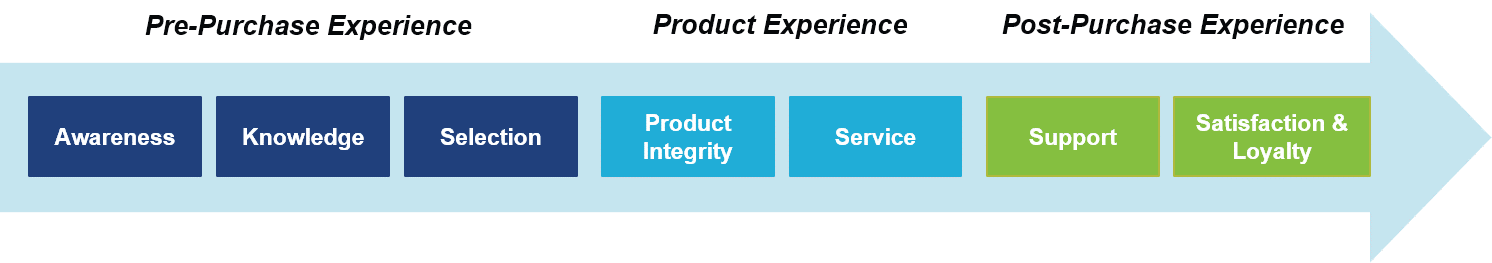

Of the touchpoints shown above, life scientists particularly value the quality of customer service and technical support. When a customer experiences a problem, outstanding, “beyond-the-call-of-duty” service can generate corporate goodwill. But it is not possible to build loyalty solely on the basis of a talent for narrowly escaping disaster. Life scientists define as “valuable” any product or service that elevates their performance or lowers their costs. Responsive service and support contributes to both of these objectives. Individual or laboratory performance is heightened when ordering and delivery problems are avoided, or technical issues are resolved quickly. Lowering costs does not simply refer to the price of the product, but also reflects time and convenience costs. In a market where technological differentiation is becoming so difficult to achieve, providing quality service and support an exceedingly important element of creating a branded customer experience.

But what are some other areas of importance? Here we jump back to the beginning of the customer experience journey — awareness, product knowledge, and product selection. Unfortunately, scientists take some of these corporate activities for granted or see them as secondary despite the impact they have on their overall customer experience. For example, overall the industry averages for the pre-purchase phase are lower than any other phase of the customer experience. This is ironic because scientists curious and are happy to explore instrumentation for themselves and listen to their colleagues and peers to learn more about products. This suggests suppliers must continue to invest in resources to fulfill this need for information, a need that is especially acute during the pre-purchase phase of the purchasing cycle. These investments range from user-friendly and intuitive website design, search engine optimization, and the development of comprehensive website content. This will also assist in the Product Selection touchpoint where the industry is clearly under-performing.For some products such as instrumentation, an empowered sales force is essential to facilitating the transition from lead to customer.

In addition to these factors, taken as a whole, our analysts found that scientists also genuinely want to build better and closer relationships with their suppliers. We interviewed members of The Science Advisory Board and learned that scientists feel that suppliers seem to lack the perspective of what a lab scientist (academic or industrial) may truly need at any given touchpoint of the customer experience. This frustration can be heard in comments on touchpoints as simple as poor web design, advertising that scientists feel is misleading, and even technical support that doesn’t understand the product that it is supporting. It is important to carefully consider how your customer experience can build and nurture customer relationships.

Our report, Benchmarking for 2019: Life Science Customer Experience explores, in depth, customer perspectives of each touchpoint within the journey, your overall rating, and how your customers’ views have changed over the last three years. The full report contains detailed profiles and comparisons of 27 leading suppliers. In addition, a companion interactive report gives you the ability to filter the data by company, market segment, region and touchpoint to conduct your own analysis and presentations.