Bio-Techne is the IBO 2016 Company of the Year!

The Instrument Business Outlook “Company of the Year” Award honors a company that has demonstrated outstanding technical, operational and financial achievements during the year. IBO’s 12th annual “Company of the Year” Award goes to Bio-Techne. In 2016, life science research and biopharma drug development were key markets for technical innovation, sales demand and customer engagement. Bio-Techne capitalized on opportunities in each area to drive top line growth, expand geographically, and solidify both its core consumables product lines, and newer instrument and diagnostic pathology businesses.

In 2016, the success of the company’s new strategy and investments, which began in 2013 under incoming CEO Charles Kummeth (see IBO 6/15/13), was fully evident. In fiscal 2016 (ending June 30, 2016), Bio-Techne recorded it strongest top line organic growth over the last eight years, maintained strong free cash flow, which expanded 6% to $127 million, and improved adjusted EPS 7% excluding currency. For the calendar year 2016, adjusted EPS are expected to climb nearly 9% excluding currency. In addition, share price jumped 14%.

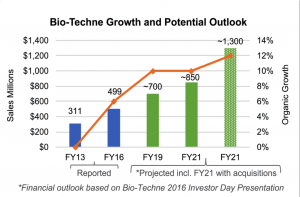

Just three years ago, under the former name Techne, the company was mainly a niche provider of specialized proteins, with fiscal sales of $311 million and flat organic growth. Today, the company has quickly expanded into a diversified provider by product, application, end-market and geographic region. As such, sales reached roughly $500 million for the fiscal year, representing an annual increase of 10%, or 6% organically.

Over the three-year period, sales have advanced more than 60%, driven primarily by acquisitions, but also new products, stronger organic growth and global expansion. In 2016, the company continued to grow, executing its acquisition strategy with the purchases of Zephyrus Bioscience (see IBO 3/31/16) and Advanced Cell Diagnostics (see IBO 7/15/16), each of which target fast growing markets with highly differentiated technologies.

Last year’s growth was led by the Protein Platforms division, with organic sales in the first nine months of the calendar year climbing more than 20%. The growth reflected the impact of organizational changes to strengthen sales and marketing. In 2016, the division updated its Maurice system for imaged capillary electrophoresis, an example of meaningful product enhancement, and how instrumentation can be the centerpiece of simplified workflows and application flexibility.

Accounting for 64% of company revenues in fiscal 2016, Bio-Techne’s core reagents Biotechnology division, which includes the well-established R&D Systems, Novus and Tocris brands, also performed well, with sales up 6% organically in the first nine months of the calendar year. New products were aimed at faster growing application areas, and the company strengthened its OEM relationships with value-added content. In addition, operational accomplishments included an increasing presence in China, one of the fastest growing markets for life science products. Organic sales in China for the three brands rose 25% organically in fiscal 2016.

Similarly, the company’s Diagnostics segment advanced roughly 6% organically in the first nine months of 2016, despite reimbursement pricing pressure in the first half of the year.

With an overall strategic goal of reaching $1 billion in sales, Bio-Techne has targeted fiscal 2021 sales of $850 million and 10% organic sales growth. However, the company’s acquisition strategy is far from over and will continue to focus on, among other initiatives, instrumentation platforms, revenue growth, scalability and geographic regions. With over $1.2 billion allocated to acquisitions over the next five years, the company has envisioned a best-case scenario to attain $1.3 billion in sales by 2021 and organic revenue growth of 12%. This scenario also includes adjusted EPS CAGR growth of 12% over the five-year period.

Congratulations to Bio-Techne! Read more in the IBO 2017 Forecast Issue. The 39-page Forecast Issue highlights trends and projects expected growth in ten major segments of the life science and analytical instrument and consumables market, as well as an analysis of regional and end-market developments. Purchase the IBO 2017 Forecast Issue.