Market Research Toolbox: Determine The Ideal Mix of Product Features

The Ideal Mix of Product Features is Essential to Creating A Successful Product

We speak with many customers working in all segments of the life sciences and we’re still surprised to learn how few of these companies perform rigorous market research during product development. Historically, life science companies have been product driven – where a new product is given to marketing/sales who are then asked to sell it.

However, there are many reasons to conduct market research before developing a product, including:

- The product must appeal to the customer (however widely defined)

- Timely market research can help you mold the product to the consumer’s need/wants

- Market research tends to point out successes and failures before products are launched “for real”

- If you are going to fail — fail early

While these seem intuitive many of our customers simply don’t do these things – either because of institutional inertia, lack of financial resources or a lack of time. When we’re talking about new product development, it’s good to keep in mind that we’re not only talking about “new to the world” products – as they only represent about 10% of products launched. Product updates, extensions, repositioning, and new applications represent 90% of the launches. While the various types of launches require various types or depth or market research – it’s always advisable to use some type of VOC to guide these launches.

New products fail for a number of reasons – Perhaps R&D doesn’t fully understand the needs of customers, or if they do, the effort to develop that “perfect” product makes it cost prohibitive. There may be also be a problem with product positioning, the products benefits may not be communicated well, competitors may have recently launched a competing product, or the market may simply not be ready for the innovative new product you’re selling.

At BioInformatics we have a wide variety of analytical tools to help support product development. Today we’re discussing an approach that shows which product features will have the greatest impact on customer satisfaction. Using our Kano Model Analysis to discover Preferred Product Features, suppliers can determine the ideal mix of product attributes that will lead to increased customer satisfaction, market share, and revenues.

Case Study: Which product attributes are most important to my customers?

In a recent study, a client asked Bioinformatics to conduct a market opportunity assessment for a product they planned to introduce within the next year. The client wanted to know which product features are most important to their customers. We were able to analyze the importance of each feature selected by the client using the Kano Model. This analysis provides a detailed picture of the customer’s ideal mix of product features.

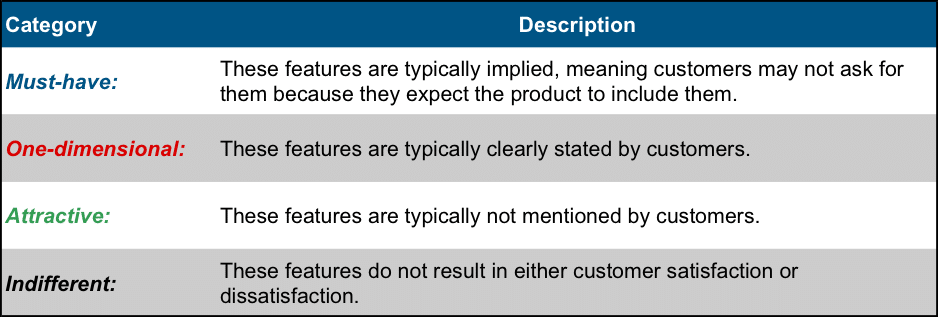

The Kano model asks end-users to rate selected product features of the new product using a ranking system designed to understand how the end-user would feel if the product feature was or was not present in the new product’s design/function. Using a sophisticated evaluation table, their responses were used to classify these features into one of four quality categories:

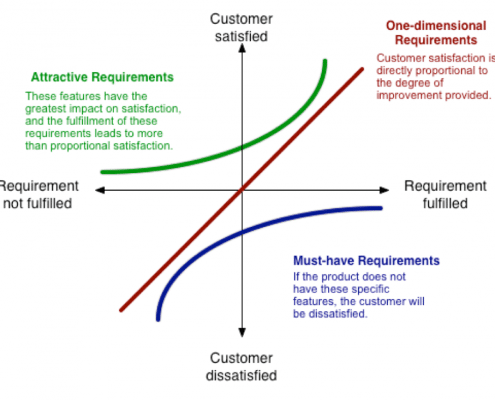

The quality categories are mutually exclusive and based on two factors: customer satisfaction and the requirement of the feature being fulfilled. The graphic below (of Kano Model output) displays customer satisfaction on the Y-axis, and the fulfillment of required features on the X-axis. The combination of these two factors determines to which category each feature is classified.

To get more information on the ways BioInformatics can support your product development efforts, please contact Greg Thompson at 703-778-3080 x-22 or [email protected]